Quickbooks payroll tutorial for desktop how to#

The course will describe how FIT is calculated, what is needed for QuickBooks Pro to calculate FIT, and how to enter the data into the accounting system. We will discuss Federal Income Tax (FIT) calculations within QuickBooks Pro Desktop 2019. The course will walk through the process of entering a new employee into the QuickBooks Desktop Pro 2019 system and describe where the data would be received from in practice including Form W-4. We will discuss payroll legislation that will affect payroll calculations within QuickBooks Pro Desktop 2019 and list the payroll forms we will need to generate from Quickbooks.

Quickbooks payroll tutorial for desktop manual#

This course will introduce the payroll set-up in the QuickBooks Desktop Pro 2019 system, walking through payroll screens for both the paid version and the free manual version of payroll within QuickBooks Desktop.

QuickBooks Desktop Pro 2019 payroll will describe the payroll process for a small business in detail, so bookkeepers, accountants, and business owners can better understand how to set up payroll, process payroll, and troubleshoot problems related to payroll.

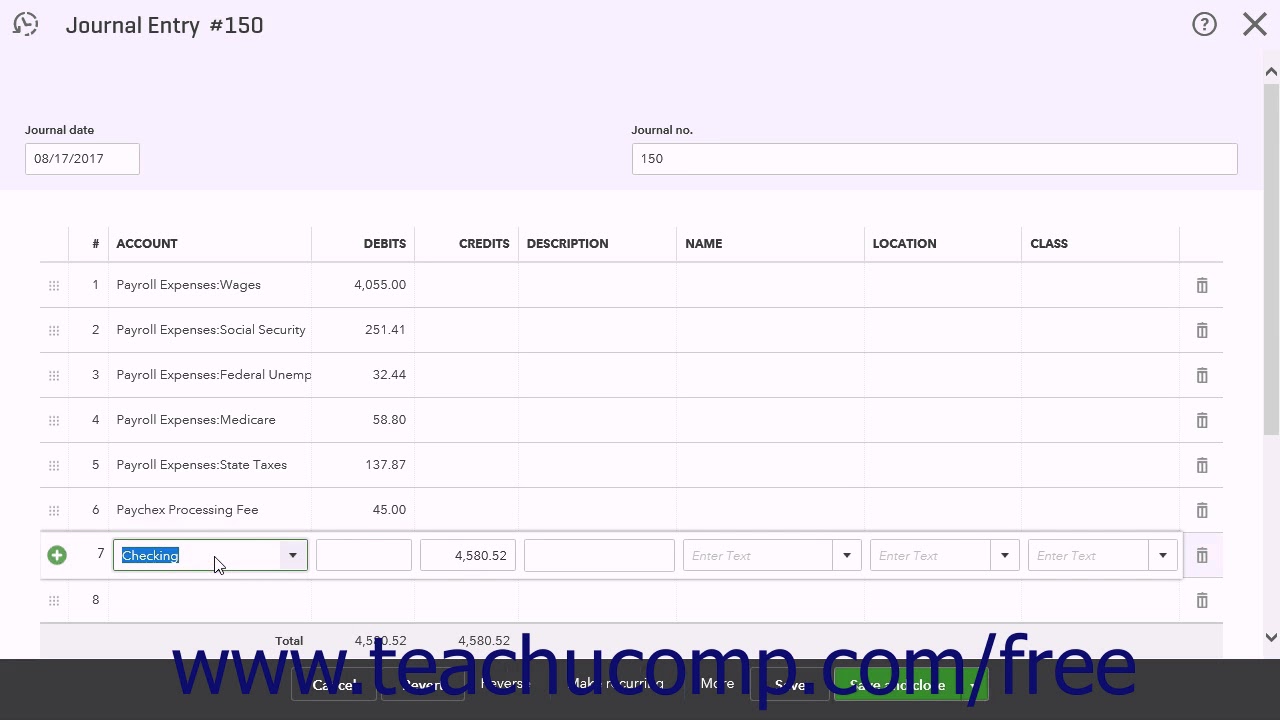

We should be familiar with QuickBooks and or accounting. Pay payroll liabilities using QuickBooks Desktop Pro 2019 Process payroll in QuickBooks Pro Desktop 2019 Setup Manual payroll in QuickBooks Pro Desktop 2019 Setup paid payroll in QuickBooks Desktop Pro 2019 List and describe types of retirement plans and how to set them up in QuickBooks Desktop Pro 2019Įnter comprehensive payroll problem into QuickBooks Desktop Pro 2019 Generate and analyze a payroll register and payroll reports from QuickBooks Desktop Pro 2019ĭescribe mandatory and voluntary deductions and how they are entered into QuickBooks Desktop Pro 2019 Generate and analyze Forms W-2 & W-3 in QuickBooks Pro Desktop 2019 Generate and analyze Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return in QuickBooks Pro Desktop 2019 Generate and analyze Form 941 Employer's Quarterly Federal Tax Return in QuickBooks Pro Desktop 2019 Generate payroll journal entries from payroll reports in QuickBooks Pro Desktop 2019 Set up and calculate Federal Unemployment in QuickBooks Pro Desktop 2019ĭescribe and calculate employer payroll taxes in QuickBooks Pro Desktop 2019 Set up and calculate Medicare in QuickBooks Pro Desktop 2019 Set up and calculate social security in QuickBooks Pro Desktop 2019 Set up and calculate Federal Income Tax (FIT) In QuickBooks Desktop Pro 2019ĭescribe the Federal Income Contribution Act and its components List and describe payroll related legislationĮnter new employee information into QuickBooks and describe where to get the data necessary to add a new employee Processing QuickBooks Pro Desktop 2019 payroll for a small business, generating paychecks, processing payroll tax forms

0 kommentar(er)

0 kommentar(er)